Kushaal and his journey with Startups!

⏱️

Fun fact: Kushaal is the one breaking the ice in Verak’s in-person quarterly catchups. Kushaal makes it a point to just shake hands and talk with everyone there so that they feel comfortable! There’s a reason why everyone in Verak knows and loves Kushaal

Intro

Kushaal is a Chartered Accountant and a CFA candidate equipped with the tools and knowledge that perfectly suit an innovative, growth-driven company like Verak. His journey from an Articled Assistant to Finance Manager to Finance Controller has taught him a lot of lessons & made him a finance rockstar with 7 years of domain experience

Career

- Kushaal did his articleship in a mid-sized firm where he got exposure to basics and advanced concepts of Auditing, Income Tax, Sales Tax etc, especially for small and medium-sized businesses.

- Post qualification of CA, Kushaal knew that he had done enough compliance work & wanted to add value to whichever organisation he works for. So he decided to enter the core finance domain straight away. From then till date, Kushaal has been working with startups in the finance domain for around 7 years.

Kushaal, like many others, had no idea about finance topics like FP&A or Business Finance when he cleared the Chartered Accountancy course. However, he was quick to pick them up and now is an expert in advanced concepts like forecasting and fundraising.

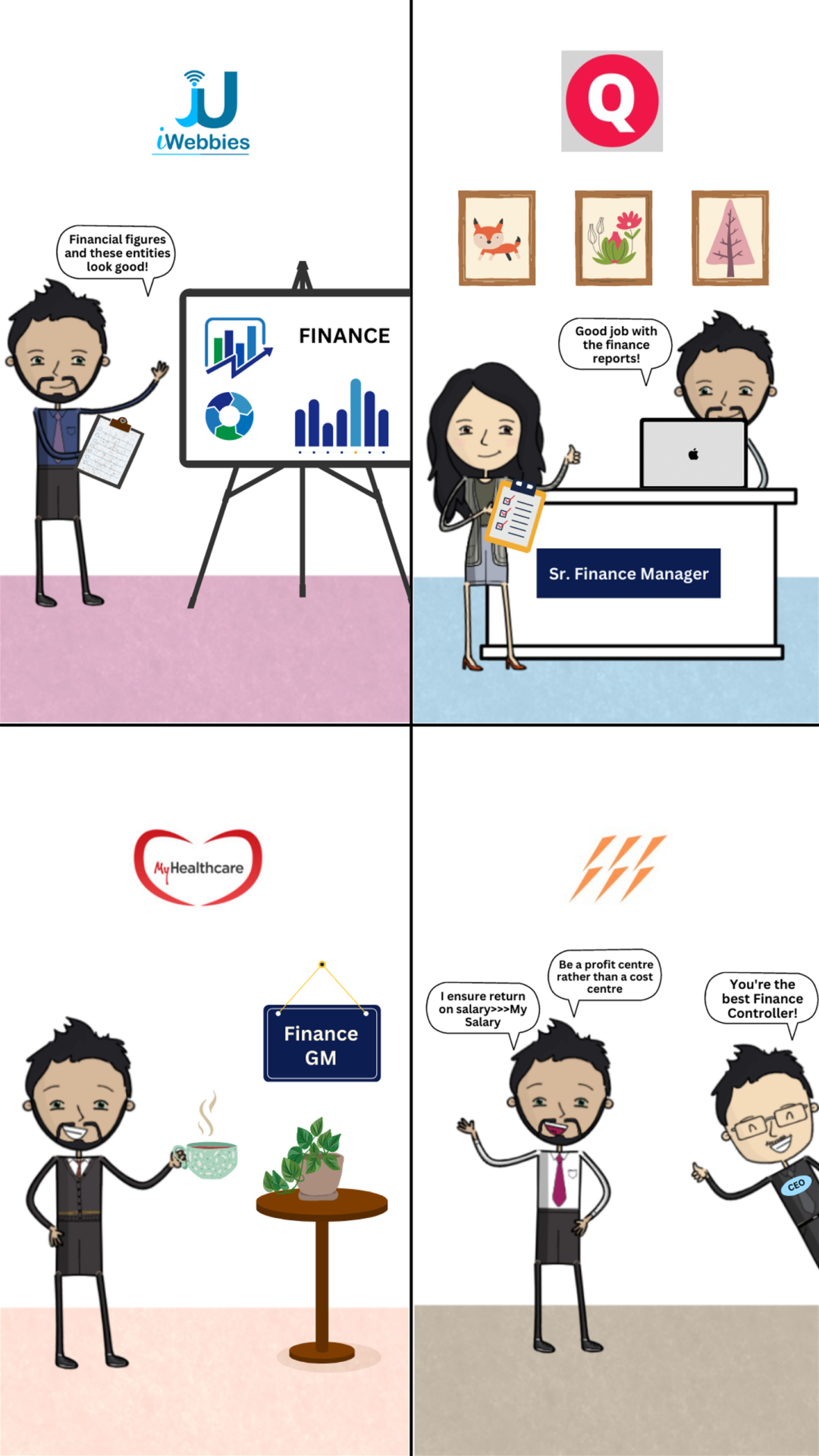

- Firstly, he joined iWebbies, a tech-enabled digital marketing solutions provider where he worked on hardcore finance for a year.

- He then worked for 3 years in Quotel, an Online One-Stop Solution for Architectural Products as Senior Finance manager.

- He then had a stint at MyHealthCare Technologies for a year and a half as GM of Finance

- He’s presently killing it as the Finance Controller at Verak!

Disclaimer: This interview was taken when Kushaal was working at Verak, he is now working at InsuranceDekho!

About Verak

Verak is an IRDAI-certified business insurance provider for MSMEs in India. Its goal is to be the preferred business insurance brand for 1M+ MSMEs by 2027.

Its platform allows business owners to:

- Generate a commercial insurance quotation instantly

- Get expert guidance on selecting the policy best suited to their business

- Have one-click support for endorsements, claims, and everything in between

How Kushaal manages Finance at Verak

Right from day 1, Kushaal was keen to look at himself as a profit centre rather than a cost centre. He was keen to ensure that the return on his salary was always more than his salary. That’s exactly why Kushaal implemented as many processes as possible, soon after joining Verak. For instance, they use as much software as they can to streamline & manage different aspects

- RazorpayX for Payroll

- Carta for Cap Table Management

- Budgeting & Forecasting, after discussions with the founder, sales team etc.

This streamlined approach helps him focus on what he should do, and also clear audits and due diligence easily.

Also, Kushaal gets a lot of support from Verak’s founder who himself understands and enjoys finance as much as Kushaal does.

The balance between in-house & outsourced functions

Due to the very nature of it & the context required to master them, Kushaal believes that the following aspects of Finance must be the last ones to be outsourced:

- Business Finance

- Budgeting & Forecasting

How does Kushaal spread out his day?

- Kushaal spends around 30% of his time managing compliance which is dynamic & ever-growing. This is also specific to Verak since it’s a regulated space (insurance)

- 20% of his time goes into accounting and other legal matters, fundraising etc.

- The remaining 50% is where the magic happens, as per Kushaal. It is completely focused on the business, discussing each and every aspect of the business with the founder and the sales team to understand the company’s prospects, projections etc. This in turn helps Kushaal guide the founders to take the right strategic decisions.

Kushaal believes that Finance rockstars must come out of their comfort zones & start conversing more with different members of the organisation to get an inward-looking view of the business.

When should a startup have a finance team (or a person)?

Kushaal strongly thinks that a dedicated person must be hired to manage finance once the product is built and sales have started ticking in. And more importantly, he feels that the hire should be a competent person so that he/she can guide on compliance as well as help the founders with decision-making inputs. It’s always to pay his/her salary than interest/penalty to the government.

How can a consultant differentiate it from others?

The need of the hour is to have a firm that is actually providing Virtual CFO services rather than just mentioning that in its website or profile.

How can this be achieved?

- Take the headache away from the founder – COMPLETELY

- Provide insights to the founder on

- mismatch in projected vs actual revenue

- future cashflows

- fundraising requirements

- Not just submitting the reports but also analysing & interpreting them!

- Keen eye on Understanding the business