Intro

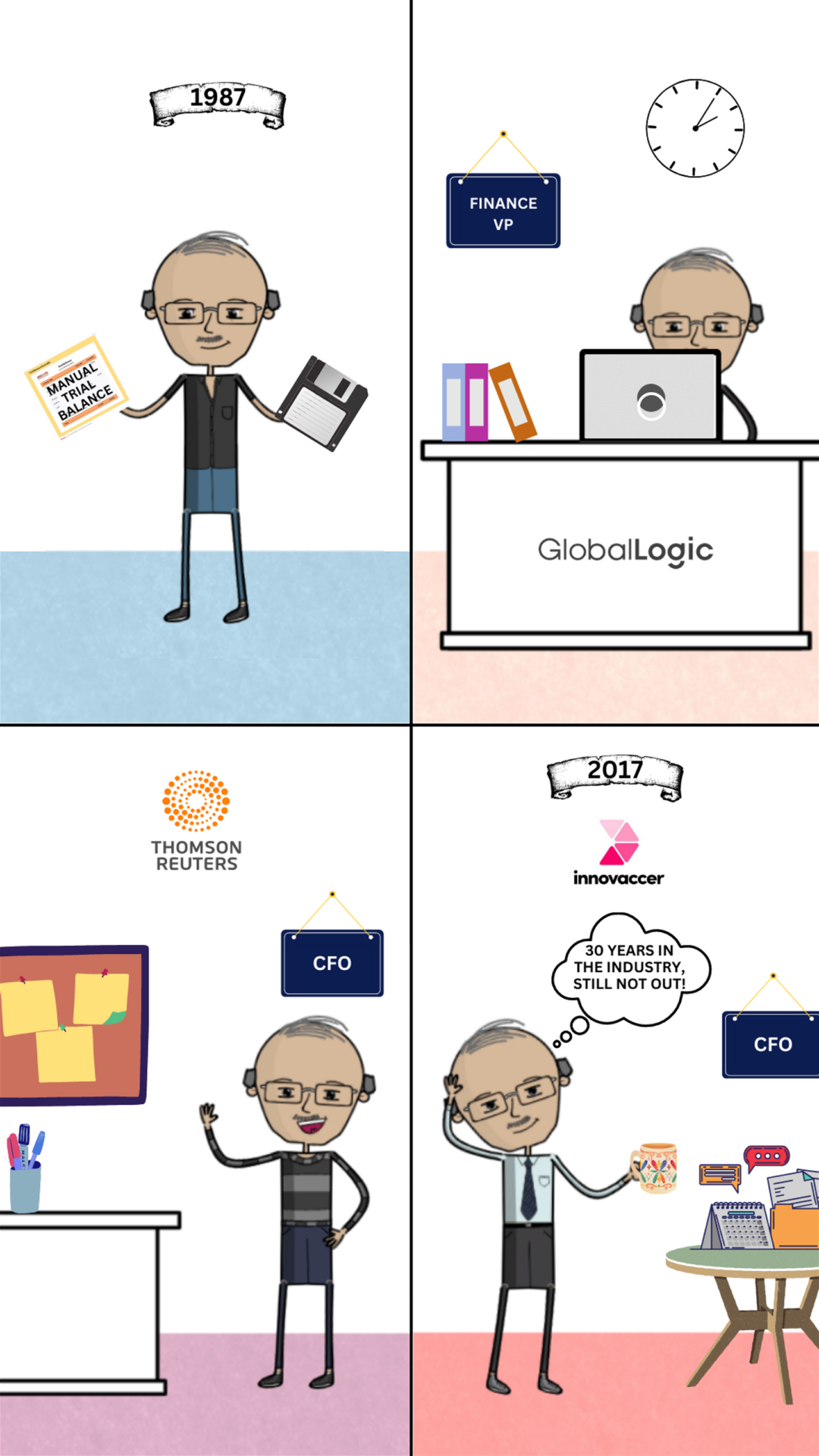

Mr. Naveen has been helping the startup industry manage their finances for the last 35 years.

From trying to match the trial balance on paper, to now automating everything on computers, he has definitely seen the world turn around.

Career

- From trial balance to a floppy disk and now using various automation and softwares for finance, Naveen has come a long way.

- He started his career in the year 1987 as a Senior Accounts Manager at Bharat Electronics.

- He then spent 2 years with Bharat Electronics

- He later moved to Star Paper Mills in the early 90s and helped them as an Assistance Finance Manager.

- For the first 11 years of his, he was into manufacturing. In these 11 years. he saw various trends, faced many challenges, worked on manual trial balances (can’t even believe that’s real), used Floppy Disk and Lotus 1234, and a lot more.

- In the later years, IT stepped it’s foot in India. Since this industry was new, there were no experts in it and hence were hiring people majorly from a Manufacturing background. Here, Naveen got a chance to work in the IT industry and help them with their finances. The transition here was huge and exposed him to 2 new things:A. Managing people/team trans boarder.B. Reporting to the corporate head office outside IndiaThis helped him learn how they think and work- which was an all new experience for him.

- In the year 1998, he became the VP of Finance at Xansa.

- After helping Xanas for more than 6 years, he joined hands with Global Loggic as a Finance VP.

- He then moved to Pangea3 as a CFO and continued there for more than 8 years.

- In the year 2016, he joined Thomson Reuters as a CFO and helped them for 8 years.

- Currently, he is working as the CFO at InnovAccer which he joined in the year 2017.

The Last 356 years have been quite a rollercoaster for Naveen!

Disclaimer: This interview was taken when Naveen was working at InnovAccer, he is now working at LambdaTest.

How things have been so far for him

Over time, Naveen has learnt that nobody looks at finance and accounts when the startup starts. All focus is on product development, all focus is on getting customers and growing revenue. Nobody looks at finance and that is the pain point.

He says that he has seen opportunities in chaos.

The opportunities are huge and he has seen chaos again and again, where things are haywire. But if one can streamline it, one can definitely make it out of it.

About InnovAccer

InnovAccer is a Data Platform for Healthcare. It unifies patient data across systems and care settings and empowers healthcare organizations with scalable, modern applications that improve clinical, financial, operational, and experiential outcomes.

Challenges startups face

“In the initial days of a startup, you will have to burn money to grow.” ”But people don’t understand that you cannot grow if you don’t track cashflow because cash is the king.” – Naveen

One of the most prominent challenges startups face is that they do not have proper compliance and cashflow statements

⭐

In the initial days even if you have to burn cash, you need to have a path to profitability.

When should a startup bring in its first finance person?

Naveen says that the best time to hire a finance guy is as soon as possible.

⭐

Most often founders think that they can cut down on not having a CFO as the costs and expenditures are minimal.

In case, a startup isn’t able to hire a finance guy at the very beginning, the next best time to do so is at the time when your product finds a market fit. At the time you start acquiring customers.

⭐

As a startup, if you are going to raise funds, then your valuation will only be good if your financials are good.

Ideally, after Series A, is when a startup must start looking for a CFO who can take in-charge of things, the due diligence, etc.

How finance is managed?

Naveen tells us that repetitive tasks such as payroll, regulatory compliances especially for the US, and taxes can be outsourced while supervising them.

Whereas things like P&L A/C, bookkeeping and FP&A must be done in-house.

⭐

One cannot do everything. To know and understand this while outsourcing what’s right is the best thing to do for your startup.