Shweta and her incredible 0-to-1 journey!

Fun fact: Shweta comes from a legacy CA family – her dad & brother both are Chartered Accountants but that did not stop her from wearing multiple hats in her early days – Including product testing & writing test cases!

Intro

Shweta, a Chartered Accountant from India and a CPA (Australia), is an experienced Business Finance Manager with a demonstrated history of working in the accounting industry. Her journey from an Articled Assistant to Finance Manager has been enriching & fun!

Career

- Shweta did her articleship at Rajesh Mehra & Associates in Chandigarh, where she also worked as an Audit executive post her articleship

- She then worked as a Business Finance Executive at Capillary Technologies for a couple of years. That’s where Shweta took her first lessons in Finance for B2B SaaS and then there was no stopping.

Her reporting manager in Capillary was from a Science background. This opened her eyes that it’s not just the background but the interest & keen eye for detail that matters in this evolving space. She still recollects how “new” she felt in the B2B SaaS space since most of it in SaaS is never taught in CA or articleship.

- She took a short break and joined Nektar.ai. She was one of the early hires in Nektar and presently manages its business finance.

About Nektar

Nektar.ai is a B2B sales productivity startup that develops an AI-based virtual sales assistant to improve the productivity of sales teams. In other words, it is a Connected Revenue Operations platform for modern sales teams. It helps discover hidden revenue data across the scattered sales team and Techstack!

Nektar’s killer founding team and 0-to-1 journey

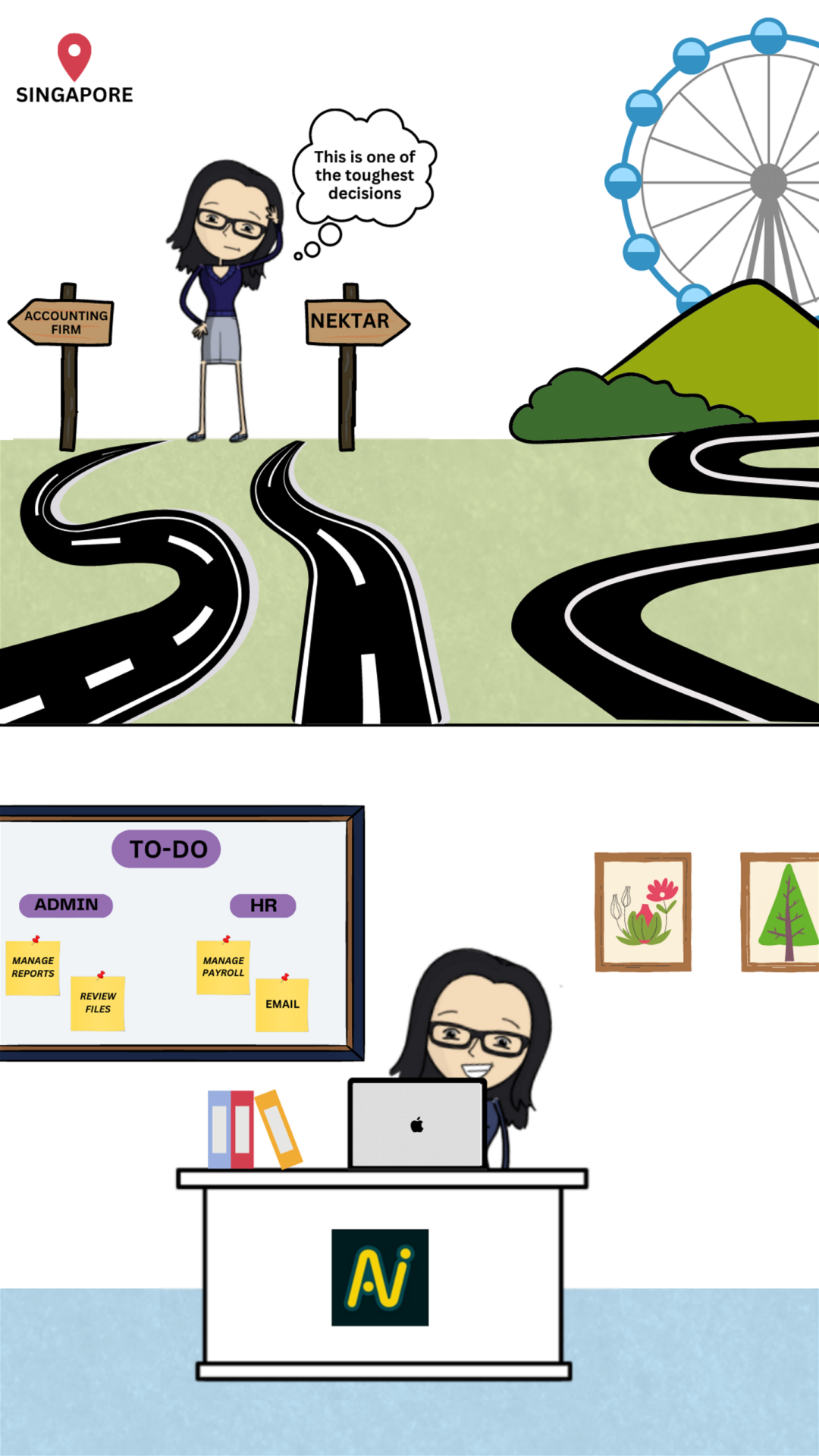

When Shweta moved to Singapore in 2020 around COVID, she had 2 opportunities – 1 with an accounting firm and 2 with a startup (Nektar). Even though there is an overlap in the responsibilities one has in an accounting firm & a startup (like compliances), the opportunity to start seeing the numbers in a different way excited Shweta and she took the leap of faith to join the startup. The rest is history!

It’s been 3 years now and counting, and she still has a very positive outlook on the company. It was indeed a little daunting at the beginning but it was worth it.

Shweta considers herself lucky that she has a good team. A team that is appreciative of her efforts and hard work. She has never felt underappreciated so far, which is not the standard.

What does working in a startup look like for finance rockstars?

Since Shweta joined Nektar early, she had to take up a role as HR as well and at times, even the admin-related work. This was obvious too because early-stage startups focus mostly on engineering, building the product and the sales team. Even today, she is the only one managing finance and compliance. She’s done it all – managing payroll, sending out invoices, ensuring customer payments hit the bank account, looking at metrics and investor relations, reviewing shareholder agreements and what not.

She even recollects how she continuously thinks about the booked revenue, CAC and runway and how her vocabulary is now completely “SaaS-based” Not just that, also undertook product testing in her early days and also wrote test cases.

Shweta’s focus is on things like “server costs” instead of what is the closing tax return filing date because the latter can be managed by consultants as well but the former has to be optimised within the organisation

When should a startup have a finance team (or a person)?

Shweta feels that it is better to have a finance person on the early journey. This is because once the accounts and finances are sorted, the investor relations, compliances and other regulations are all sorted and become easy. However, considering the fact that the founders also consider the cost perspective of hiring an accountant, maybe they can outsource that as well but at the end of the day, the numbers won’t be something that is more business relevant at a later stage.

Also, the role of the finance person in the early days can be widened to include other related aspects as well and then, the resource will be very useful and justify the cost of the resource by wearing multiple hats.

How can a consultant differentiate it from others?

- Understanding the (SaaS) business and its metrics better so that the consultant is able to help the startup with SaaS Metrics rather than just limiting to bookkeeping & compliance.

How about a community for B2B SaaS Finance rockstars?

Shweta admitted that the community-building aspect was one of the reasons why she jumped into this call. She was checking for a network that could help out with the finance. For instance, when there is some kind of query, she has to currently search around for people who can solve that up – and the search isn’t always easy. So yeah, a community will be really helpful as per Shweta. This becomes even more important since this space is not yet mature enough and there are a lot of new metrics that the founders or stakeholders want to track. If the community is able to help resolve this, then it will be a huge learning curve for its members as well.